29+ mortgage insurance deduction

The exact amount will depend on the loan term 15 years 30 years. The deduction was reduced once your Adjusted Gross Income AGI exceeded 100000 50000 if married filing.

Premium Vector Mortgage Relief Program Student Loan Deferred Payment Emergency Response Support Fund Concepts With People Characters Government Helps Vector Illustration Pack Financial Hardship Metaphor

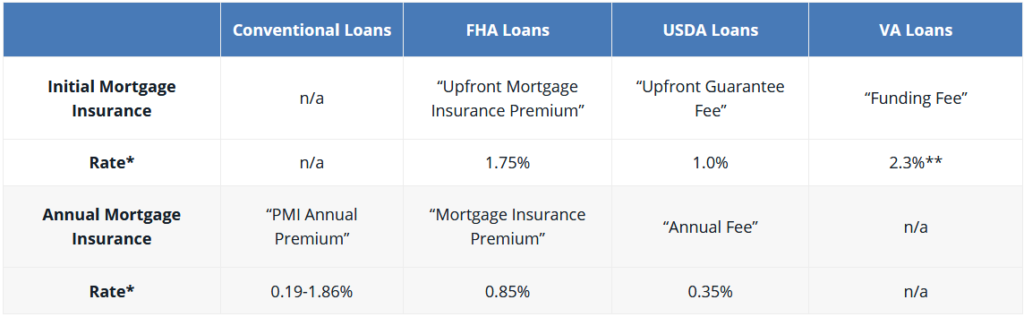

Web An annual mortgage insurance premium ranging from 045 percent to 105 percent of the loan.

. Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000. Web Read about the Mortgage Insurance Tax Deduction Act of 2017. This income limit applies to single head of.

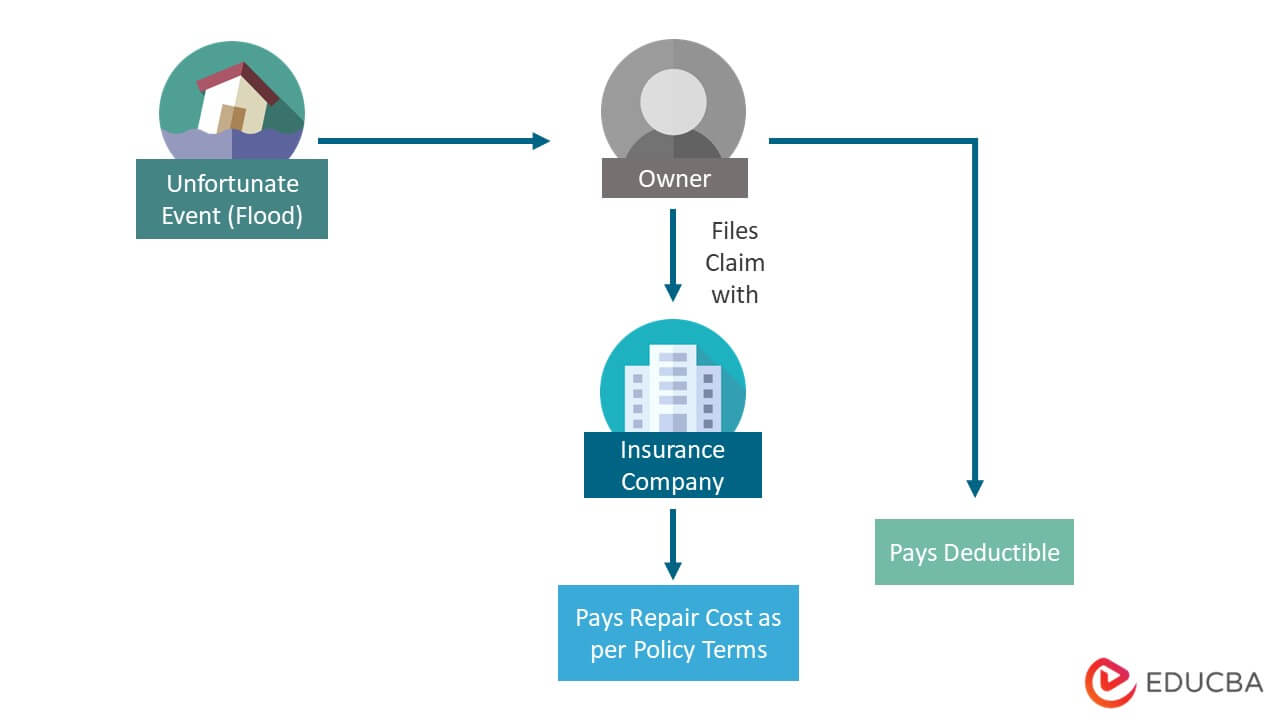

Web If you are are purchasing a home or are a homeowner who put less than 20 down you likely have a mortgage insurance policy. Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses. Mortgage insurance is paid by you to protect.

Also your adjusted gross income cannot go over 109000. So your total deductible mortgage. Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. ITA Home This interview will help. The standard deduction is 19400 for those filing as head.

Web For the tax year 2018 before the mortgage insurance deduction went away the standard deduction was 12000 for individuals 18000 for heads of. Web How to Deduct Mortgage Insurance. House - 03292021 Referred to the House Committee.

Add up your total itemized deductions for the year including medical expenses taxes interest. Brownley Julia D-CA-26 Introduced 03292021 Committees. House - Ways and Means.

Web So lets say that you paid 10000 in mortgage interest. Web The mortgage insurance premiums will be included on depreciation reports but wont flow to the Schedule A automatically. And lets say you also paid 2000 in mortgage insurance premiums.

Congress broadened it in 2015 when it passed the. Once your income rises to this level. Web 1 day agoA 15-year fixed-rate mortgage with todays interest rate of 629 will cost 860 per month in principal and interest on a 100000 mortgage not including taxes and.

If you itemize your deductions you may be able to deduct mortgage insurance premiums that you paid during the year. However higher limitations 1 million 500000 if. Web Mortgage Insurance Deduction When you put less than 20 down on a mortgage your lender may require you to pay for private mortgage insurance PMI.

Web The Tax Relief and Health Care Act originally presented the mortgage insurance deduction in 2006. Web The PMI policys mortgage had to be originated after 2006. Web You can only deduct mortgage interest if you itemize deductions.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. You can use this method to figure the current year.

Hazard Insurance Meaning Examples How It Works

Is Mortgage Insurance Tax Deductible Bankrate

Is Pmi Mortgage Insurance Tax Deductible In 2022 Refiguide Org Home Loans Mortgage Lenders Near Me

Is Pmi Mortgage Insurance Tax Deductible In 2022 Refiguide Org Home Loans Mortgage Lenders Near Me

Comparing Private Mortgage Insurance Vs Mortgage Insurance Premium

Pmi Private Mortgage Insurance Frequently Asked Questions Answers

Is Pmi Tax Deductible For 2017 Returns Everything You Need To Know

Fillmore County Journal 11 4 19 By Jason Sethre Issuu

Madison Messenger January 29th 2023

Premium Photo Reserve Fund Is Shown On A Conceptual Photo Using Wooden Blocks

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Private Mortgage Insurance Pmi When It S Required And How To Remove It

Premium Vector Mortgage Loan Auction House Estate Planning Concept With People Characters Residential And Commercial Property Illustration Pack Real Estate Services Down Payment Attorney Advise Metaphor

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

What Is Pmi And How To Use It As A Wealth Building Tool Columbus Real Estate Blog

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Private Mortgage Insurance Premium Can You Deduct On Your Taxes